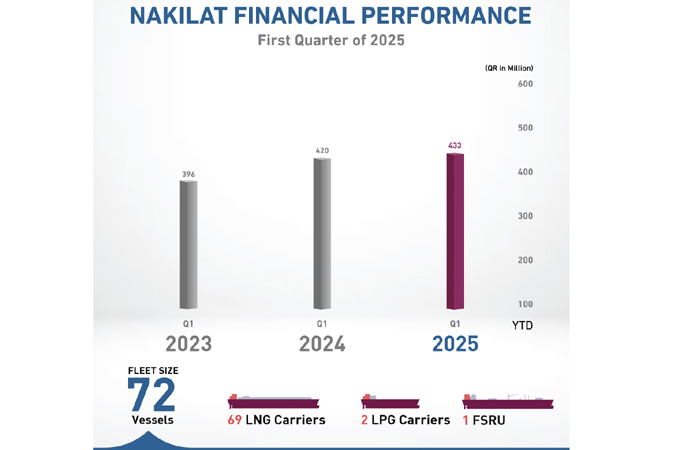

Qatar Gas Transport Company (Nakilat) achieved a net profit of QAR433 million ($118.92 million) for the first quarter of 2025, ended March 31, marking a 3.2% increase from QAR420 million recorded in the same period of 2024.

This robust performance underscores Nakilat’s resilience and strategic success in a dynamic global market, the company said.

Incurred total expenses of QAR673 million, reflected a decrease of 5.7%.

This sustained growth is attributed to Nakilat’s strategic fleet expansion, operational excellence, and unwavering commitment to delivering clean energy worldwide. Despite a challenging economic landscape marked by uncertainty and elevated interest rates, Nakilat has solidified its industry leadership, leveraging long-term agreements and optimizing fleet utilization to drive efficiency and profitability, it said.

Eng Abdullah Al-Sulaiti, Chief Executive Officer of Nakilat, commented: "Nakilat’s strong financial performance for the first quarter of 2025 highlight the success of our strategic vision and dedication to excellence. As we expand our fleet and enhance our capabilities, Nakilat continues to strengthen its standing as a global leader in the LNG shipping industry. The addition of new technologically advanced vessels and our long-term partnerships ensure we remain at the forefront of the evolving energy transportation landscape. We remain focused on sustainable growth, operational efficiency, and delivering long-term value to our shareholders and stakeholders."

Nakilat’s expansion strategy is further strengthened by its commitment to sustainable energy transportation. The company remains on track with its newbuild programme, which includes state-of-the-art LNG carriers and LPG/ammonia gas carriers under construction, marked a significant milestone with two steel cutting ceremonies for a total of ten of its new LNG carriers and four LPG/ammonia gas carriers at Hanwha Ocean and HD Hyundai Samho shipyards in South Korea in March 2025. – TradeArabia News Service