Beyon, a leading technology group headquarted in Bahrain, has announced a net profit attributable to equity holders of BD19.9M ($52.8 million) for the second quarter (Q2) of 2023, in line with BD20 million reported for the corresponding quarter of 2022.

Earnings per share (EPS) are 12 fils for the Q2 of 2023 compared to 12.1 fils in Q2 2022.

Total comprehensive income attributable to equity holders in Q2 2023 was reported at BD24.9 million, a 95% increase from BD12.8 million in the second quarter of 2022, due to foreign exchange translation differences related to the appreciation of the British Pound and investment fair value changes, the company said.

Operating profit for the second quarter of 2023 increased by 13% to BD28.1 million from BD24.7 million in Q2 2022. EBITDA is up by 5% and stands at BD44.8 million in Q2 2023 compared to BD42.9 million in Q2 2022. Revenues for Q2 2023 increased by 6% to BD105.4 million compared to BD99.2 million in Q2 2022.

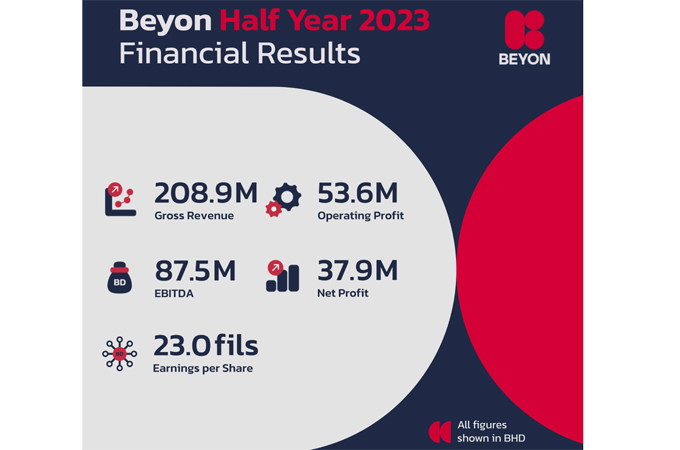

For the first six months of 2023, net profit attributable to equity holders of BD37.9 million ($100.5 million) remained stable compared to BD37.9 million in 2022 despite the BD4.8 million increase in interest expense during the period due to higher interest rates. Earnings per share (EPS) are 23.0 fils for the period compared to an EPS of 22.9 for H1 2022.

Total comprehensive income attributable to equity holders of the company was up by 78% from BD25.7 million in H1 2022 to BD45.7 million in H1 2023.

Operating profits increased by 14% from BD46.8 million in H1 2022 to BD53.6 million in H1 2023. Similarly, EBITDA increased by 5% from BD83.5 million in H1 2022 to BD87.5 million in H1 2023. The company maintained a healthy EBITDA margin of 42% in H1 2023.

Revenues for the first six months of the year of BD208.9 million increased by 6% from BD197.7 million in H1 2022, mainly due to increases in mobile, wholesale and digital services. Beyon was able to grow its overall customer base by 6% YoY with increases in mobile customers of 17% in Batelco Bahrain and 5% in Umniah in Jordan.

Beyon’s balance sheet remains strong with total equity attributable to equity holders of the company of BD508.9 million as of 30 June 2023, 3% higher than BD496.4 million reported as of 31 December 2022. Total assets of BD1,118.1 million as of 30 June 2023 are 2% higher than total assets of BD1,101.2 million as of 31 December 2022. Net assets as of 30 June 2023 which stand at BD555 million are 2% higher than BD542.3 million reported as of 31 December 2022. The company’s cash and bank balances, which reflect the 2022 final dividend of 19.0 fils per share paid in April 2023, are a substantial BD221.5 million, it said.

The Board of Directors has approved an interim cash dividend for shareholders of 13.5 fils per share or 13.5% of paid-up capital for the six-month period of 2023. This is in line with the 2022 interim dividend payment and the Board of Directors commitment to continuously deliver strong returns to shareholders.

Beyon Chairman Shaikh Abdulla bin Khalifa Al Khalifa, announcing the financial results following a board meeting at Beyon Campus, Hamala, said: “Beyon continued to focus on the advancement of its digital growth and strengthening its core services, and the Board of Directors is pleased with the progress made in executing its strategic plans across the group, reflected by increased revenues, operating profit and EBITDA, of 6%, 13% and 5% respectively in Q2 compared to the same period of 2022.

“The Board of Directors is focussed on driving value for shareholders, and we remain committed to delivering good returns on their investment,” Shaikh Abdulla stated.

“During the second quarter, marking a key milestone in our transformation journey, the company’s ticker symbol was changed from BATELCO to BEYON. This aligns the information displayed at the Bahrain Bourse with the Beyon identity. Beyon also announced its biggest ever investment in digital infrastructure with a commitment of more than $250 million towards international and regional cable connectivity and building advanced data centre facilities. Such significant investment will grant Bahrain direct access to a global cable system with complete independency for the first time which will enhance Bahrain’s position as an international data hub. This will help to support the acceleration of Bahrain’s digital transformation and the growth of its digital economy in line with the Kingdom’s vision for 2030,” Shaikh Abdulla noted.

Beyon CEO Mikkel Vinter said, “Beyon accelerated the momentum of the first quarter of 2023 leading to a number of important achievements in Q2. The business continues to perform well, and we have maintained our profitability despite the high interest rate environment.”

“We are delighted with the Beyon digital companies’ recent accomplishments which included excellent achievements at Beyon Money, with the company launching Flexi Invest the first high yield and flexible investment solution in Bahrain and the MENA region. Strengthening its position as a financial super app, Beyon Money now allows customers to save and earn whilst having access to their money at any time,” he said.

“On the connectivity side of the business, we are committed to delivering the highest quality of services for Bahrain’s consumers and businesses through Batelco and are proud to have maintained our position as Bahrain’s #1 network for the third year in a row by providing the fastest 5G mobile network experience with 100% nationwide coverage, as well as best video streaming experience and high voice quality, as per the recent Mobile Quality of Service Report from the Bahrain TRA,” Vinter added. –TradeArabia News Service