Ambitious government initiatives are fuelling robust expansion in the UAE's construction industry, with output projected to grow to $130.8 billion by 2029, according to the 2025 UAE Construction Landscape Review from global property consultancy Knight Frank.

The total value of construction output across the Emirates has been increasing steadily since the start of the decade. After construction output reached a record $107.2 billion in 2024, the latest forecasts show this solid growth trajectory continuing every year through to 2029, growing by 4% per annum.

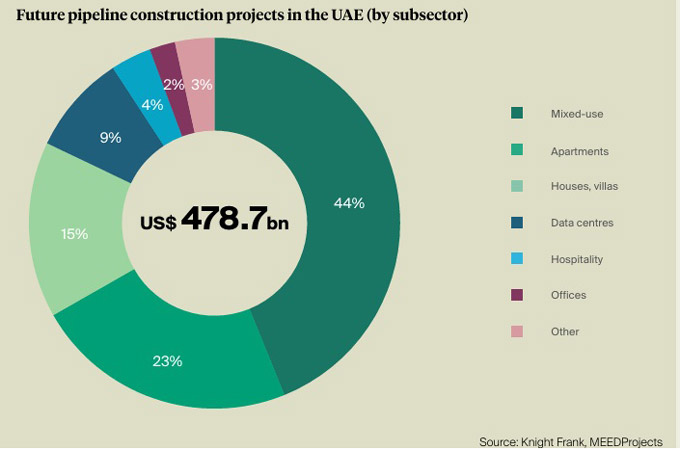

Construction dominates planned development across the UAE, accounting for 62% of future pipeline projects, ahead of transport (12%), power (7%) and water (5%). Within this construction pipeline, mixed-use projects account for 42%, followed by residential real estate (28%), data centres (9%) and hospitality projects (4%).

Residential construction costs

As of Q2 2025, residential construction costs ranged from AED4,200 per sq m for standard villas, rising to AED11,000 per sq m for high-end villas, while apartments ranged from AED4,300 per sq m, climbing as high as AED9,500 per sq m, Knight Frank says. The cost of constructing commercial buildings at the end of H1 2025 ranged from AED5,500-7,300 per sq m.

Faisal Durrani, Partner – Head of Research, MENA, said: “The UAE construction industry is in a period of robust growth and transformation, driven by economic diversification, tourism and strategic infrastructure investments, particularly in housing, transport and smart cities. The sector is a key pillar in the ‘We the UAE’ 2031 vision, the D33 Economic Agenda, Dubai’s 2040 Urban Masterplan and Abu Dhabi’s Vision 2030. Abu Dhabi and Dubai dominate the UAE market, accounting for 85% of the total value of contracts awarded between 2020 and August 2025 – $151 billion in Abu Dhabi and $129.9 billion in Dubai.”

In Dubai, project activity is concentrated in the construction sector (75%). This contrasts with Abu Dhabi, where it accounts for 23% of contract awards, behind oil and gas projects (40%). Notably, in Dubai, the oil and gas sectors make up only 3% of contract awards, reflecting the success of government initiatives to diversify the economy. Indeed, Knight Frank says, Dubai has been the world’s number one recipient of FDI into greenfield projects for three years running, while the wider UAE retained its position as the world’s number one recipient of FDI, relative to the size of its economy, for the second year running.

Hig-end developments

Upcoming projects in Dubai, highlighted by Knight Frank include high-end developments like the Palm Jebel Ali, The Oasis by Emaar, Marsa Al Arab, Therme Dubai, Naia Island, along with Venice at DAMAC Lagoons and Parkwood and Address Residences in Dubai Hills Estate. Dubai is also expanding its Metro system by 15km by 2029, with the construction of the Blue Line.

Moataz Mosallam, Partner – Project & Development Services, MENA, said: “Continuous strategic economic development is reshaping Dubai’s commercial real estate landscape and the latest construction output figures reflect the strong fundamentals of the market. Under the Dubai Urban Masterplan, the city’s population is forecast to grow from 3.4 million in 2020 to 5.8 million by 2040, underpinning the residential sector’s expansion. In addition, around 8.2 million sq ft of office space is under construction and is due to be delivered by 2028, but our estimate is that demand is likely to exceed supply, further supporting momentum in the construction sector.”

As part of the Dubai Economic Agenda D33, the city aims to become one of the world's top four global financial centres by 2033 and double the size of its economy within a decade. Efforts to position Dubai among the top three global cities for investment, living and business have seen multinationals expanding their regional presence, drawn by the emirate’s stability, global connectivity and pro-business reform.

Durrani added: “Efforts by the authorities to grow and diversify the economy are best reflected in the stellar performance of the emirate’s property market, with strong growth in office rents, combined with record low vacancy levels, while in the residential market prices are now 22% above the 2014 market high and the city has earned the title of the busiest $10 million homes market in the world – an accolade it has retained since late 2022. And if that wasn’t enough, hotels in the city are operating at one of, if not the highest level in the world, with occupancy averaging 81.4% during H1, supported by the world’s busiest international airport.”

Major projects in Abu Dhabi

Like Dubai, the Abu Dhabi real estate market is benefitting from government growth and diversification initiatives under the Abu Dhabi Economic Vision 2030. Major projects include a new 150-km high-speed train link with Dubai, expected to be operational by 2030, and the planned 131-km Abu Dhabi Metro, which will support the city’s growing population.

Mosallam said: “Some 890 residential units were delivered in Abu Dhabi in the first half of 2025, and approximately 33,074 are under construction and scheduled for delivery by 2029. Apartments are expected to comprise 71% of this future supply pipeline”.

Knight Frank’s research also forecasts a surge in office stock in 2027, with nearly 175,000 sq m of new office space scheduled for delivery in the capital. This follows more moderate supply additions of approximately 51,000 sq m in 2025 and just over 43,000 sq m in 2026. - TradeArabia News Service